How To Solve For Cost Of Equity

Cost of equity Risk free rate of return Premium expected for risk. Compute or locate the beta of each company Step 3.

Cost Of Equity Formula Guide How To Calculate Cost Of Equity

Retrieve the current share price P0.

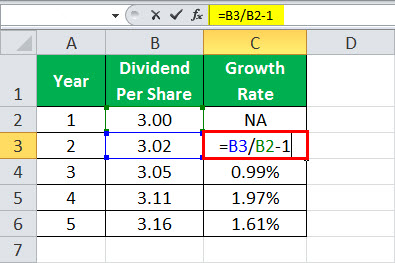

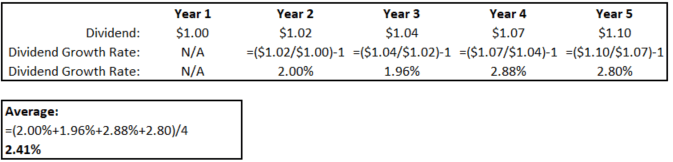

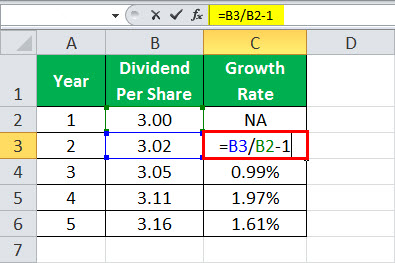

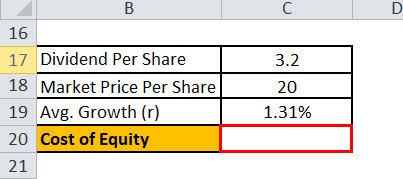

How to solve for cost of equity. It also presumes that the dividend payment will go up rather than stay the same or go down. Cost of Equity Dividend Discount Model P0 the current market price D the dividend year wise. Determine the current dividend per share.

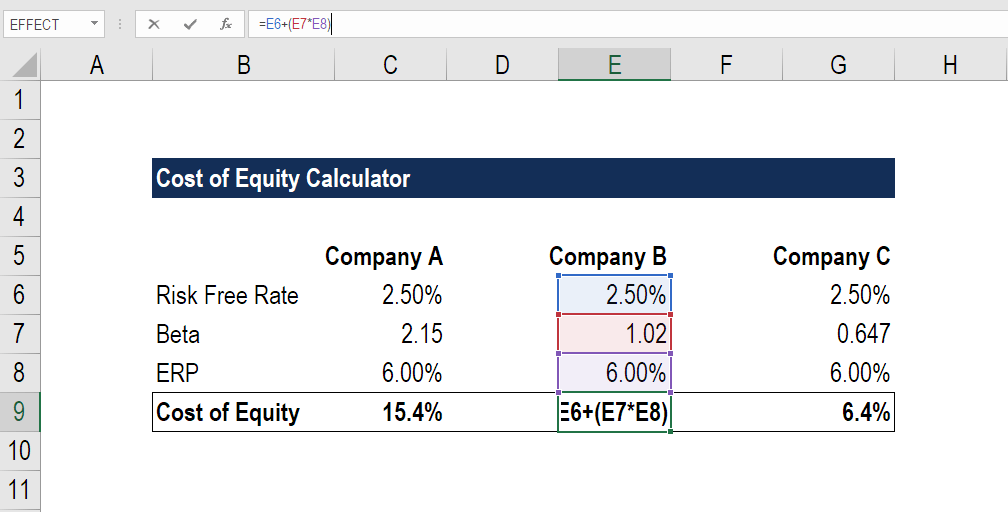

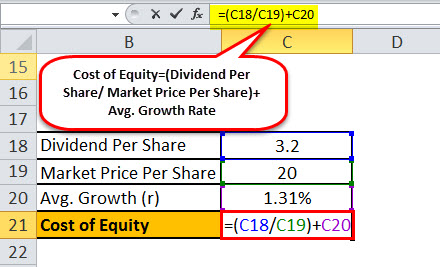

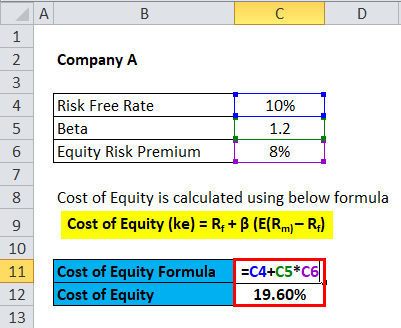

Use the CAPM formula to. Cost of Equity Example in Excel CAPM Approach Step 1. One way to derive the cost of equity is the dividend capitalization model which bases the cost of equity primarily on the dividends issued by a company.

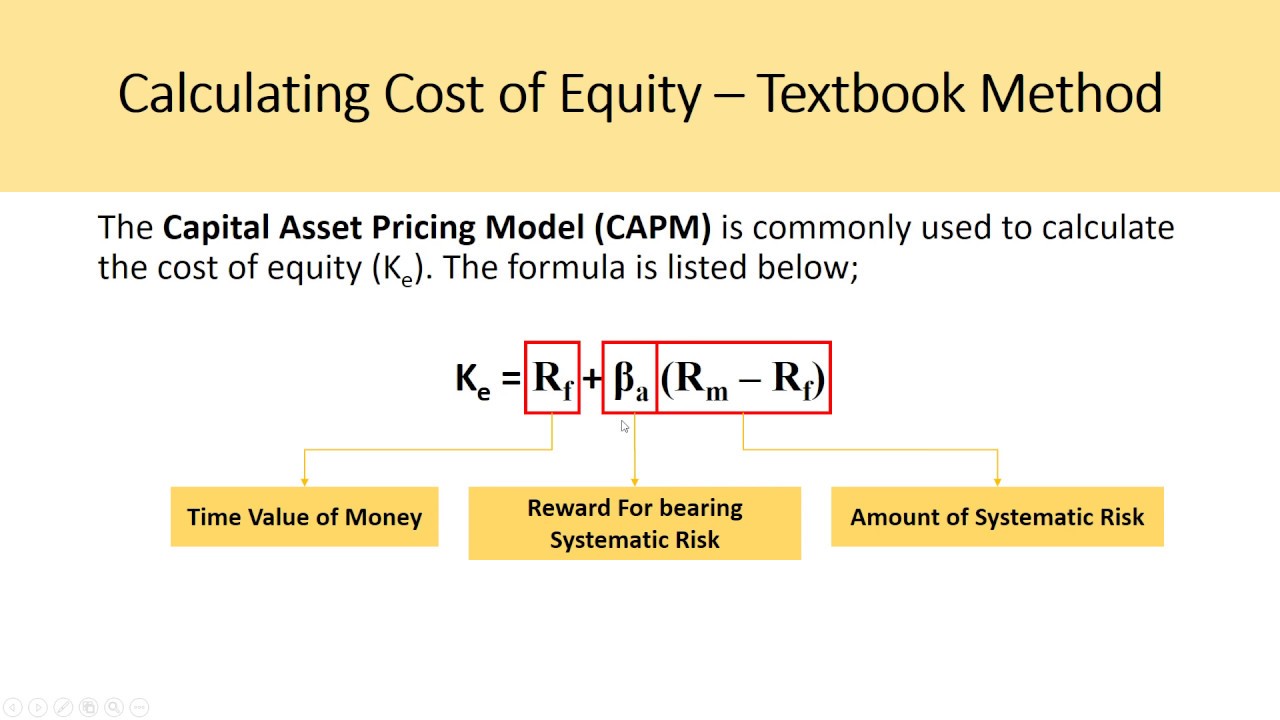

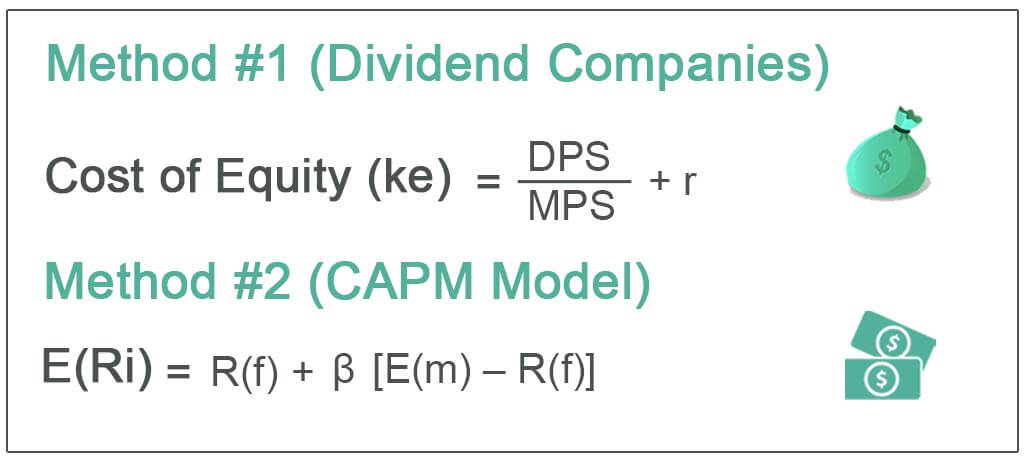

Following equation can be used to find out the cost of equity represented by. There are two primary ways to calculate cost of equity. Find the RFR risk-free rate of the market Step 2.

To use this method divide the yearly dividends by the current price per share and then adding the dividend growth rate. Therefore to estimate the cost of equity we can follow below four step s. It is commonly computed using the capital asset pricing model formula.

Calculate the ERP Equity Risk Premium ERP E Rm Rf Where. The dividend capitalization model takes dividends per share DPS for the next year dividend by the current market value CMV of the stock. Determining the cost of equity will always be a bit more subjective than the cost of debt but using these generally accepted methods you can establish a pretty reasonable rate that you can then use in your discounted cash flow analysis and in your weighted average cost of capital.

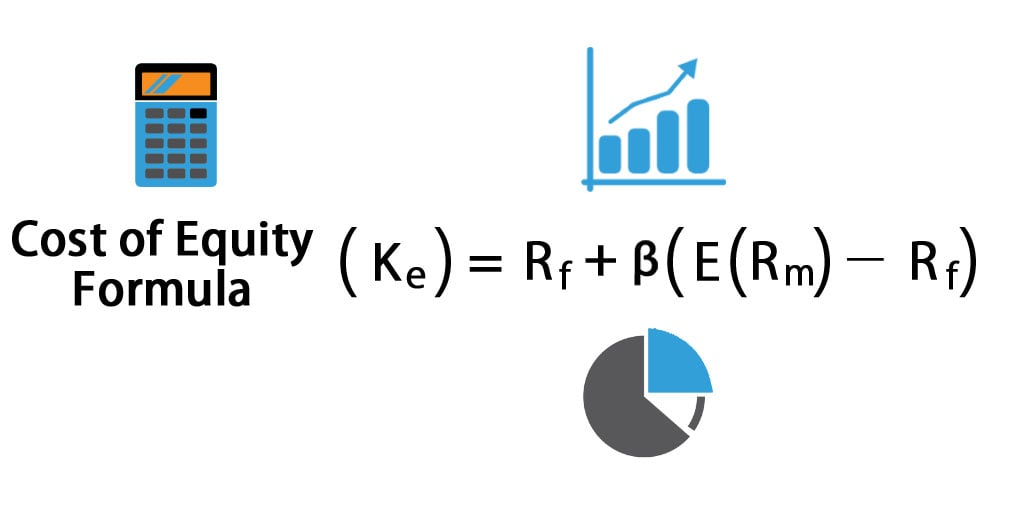

Next determine the total cost of equity. Using the formula above the CoC is found to. Cost of equity Risk free rate of return Beta market rate of return risk free rate of return One may also ask what is the average cost of equity.

For this example the cost of equity is found to be 600000. Numerous online calculators can determine the CAPM cost of equity but calculating the formula by hand or by using Microsoft Excel is a relatively. Using this model find the cost of equity of a dividend stock by dividing yearly dividends per share by the current price of one share then adding the dividend growth rate.

Keep in mind that this model does not account for stock appreciation or risk. You can use the following formula when using the dividend discount model. Finally calculate the cost of capital.

Cost of Capital formula calculates the weighted average cost of raising funds from the debt and equity holders and is the sum total of three separate calculation weightage of debt multiplied by the cost of debt weightage of preference shares multiplied by the cost of preference shares and weightage of equity multiplied by the cost of equity. E R m Expected market return R f. In this video on Cost of Equity Formula here we discuss the two methods to calculate the cost of equity 1 for dividend-paying companies 2 using CAPM Model.

Because it involves dividends and not all companies pay dividends its not always a feasible option for calculating the cost of equity. Estimate the expected growth rate of the dividend payments g.

Estimating Cost Of Equity For Wacc Dcf Model Insights Youtube

Weighted Average Cost Of Capital Wacc Excel Formula Cost Of Capital Excel Formula Stock Analysis

Optimal Capital Structure Cost Of Capital Capitals Cost

Cost Of Equity Formula Guide How To Calculate Cost Of Equity

Wacc Weighted Average Cost Of Capital Explained In Hindi

Cost Of Equity Formula How To Calculate Cost Of Equity Ke

Cost Of Equity Formula How To Calculate Cost Of Equity Ke

What Is Stock Beta And How To Calculate Stock Beta In Python Financial Analysis Capital Assets Cost Of Capital

Cost Of Equity Formula How To Calculate Cost Of Equity Ke

Weighted Average Cost Of Capital Wacc Business Valuation Calculator In Excel Business Valuation Cost Of Capital Weighted Average

Cost Of Equity Formula Calculator Excel Template

Understanding The Weighted Average Cost Of Capital Wacc By Dobromir Dikov Fcca Magnimetrics Medium

Financial Capital Structures Define Leverage Owner Lender Risks Financial Business Risk Balance Sheet

Cost Of Equity Formula Calculator Excel Template

Cost Of Equity Formula How To Calculate Cost Of Equity Ke

Weighted Average Cost Of Capital Wacc The Firm S Overall Cost Of Capital Considering All Of The C Cost Of Capital Accounting And Finance Time Value Of Money

Project Or Divisional Weighted Average Cost Of Capital Wacc Cost Of Capital Financial Strategies Budgeting Money

Cost Of Equity Formula Guide How To Calculate Cost Of Equity